Revenue-Driven Funding, Credit-Smart Options

Funding based on your sales, delivered simply and quickly. For higher funding, we combine credit-based strategies to access more substantial lending options.

At Hawthorne Corporate Credit, our core focus is revenue-based financing—helping businesses access $15K–$500K in working capital based on cash flow, not credit. Through aged corporations and CFO credit partner strategies, we implement targeted, credit-based approaches for clients seeking expanded funding capacity.

Funding based on your sales, delivered simply and quickly. For higher funding, we combine credit-based strategies to access more substantial lending options.

We don’t just offer capital — we build the corporate and credit framework that gets you approved.

Underwriter

Hawthorne Corporate Credit provides revenue-based funding driven by your business cash flow, not credit. For greater funding potential, we also use credit-based strategies like aged corporations and CFO credit partners to meet bank-ready standards and unlock higher approvals.

Hawthorne Corporate Credit is committed to advancing access to business capital through both revenue-based financing and credit-based funding strategies. By aligning with modern underwriting standards, we help established businesses secure flexible working capital and position themselves for sustained growth.

To set the standard for modern business funding, combining flexibility, speed, and strategic credit expertise to help companies thrive in any economy.

Industries: Construction, Logistics, Auto Repair

Industries: Consulting, Real Estate, E-commerce

Industries: Cleaning Services, Transportation, Retail

We match you with a clean, compliant, and funding-ready aged corporation based on your goals and industry.

If needed, we recruit and assign a Tier-1 credit partner with a qualifying FICO score to help secure maximum capital.

Our underwriters prepare your business profile, credit strategy, and corporate structure to meet all lender requirements.

Once approved, funds are issued in structured rounds—via credit lines, 0% interest rates on business credit cards, and working capital products.

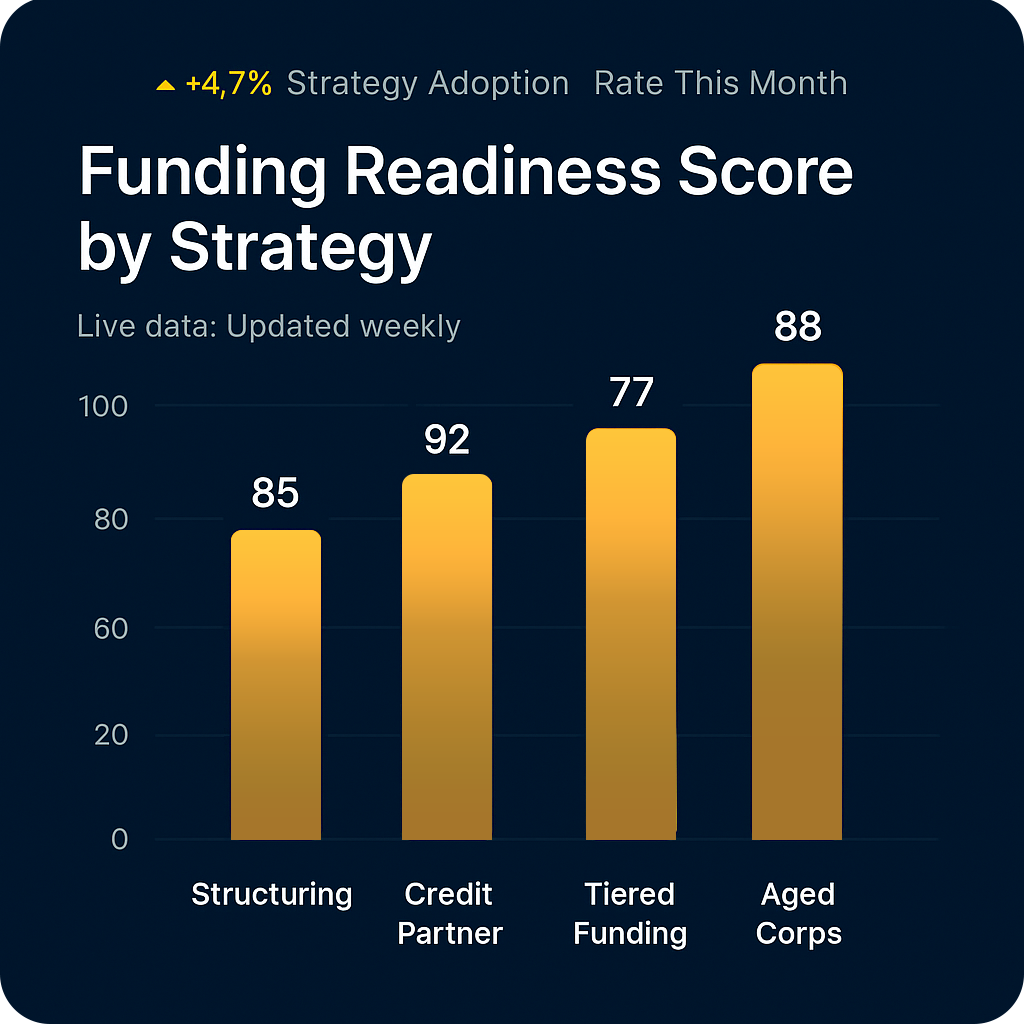

Position your company for maximum funding eligibility by aligning with bank-compliant entity standards, SIC codes, and registration profiles.

Leverage strong personal guarantors (CFO Credit Partners) to unlock high-limit credit lines and loans—without risking your own credit.

Access funding in structured rounds to match your company’s stage of growth, ensuring you never over-leverage or underfund your business.

Acquire pre-established, clean corporations to instantly elevate your fundability profile and access higher lending tiers.

Tell us about your project, the capital you need, and how you plan to use it. Our team at Hawthorne Corporate Credit will create a tailored funding solution to help you reach your goals.

Call For Funding Inquiry

Email Us

The right capital strategy starts with your vision — tell us what you’re building and we’ll make it happen.

We’ve compiled the most common questions business owners ask about our funding solutions, aged corporations, and credit partner strategies. If you don’t see your question here, reach out—we’re here to help.

Contact Us NowAn aged corporation is a company that has been legally established for several years but is not actively operating. We connect clients with these entities to build fundability and credibility with banks and lenders.

No. While strong credit increases approval odds, our strategies—including CFO credit partners—help clients with less-than-ideal credit still access funding.

Most clients qualify for $150K to $500K in unsecured funding, depending on credit, business structure, and underwriting.

From onboarding to funding, the process typically takes 2–4 weeks, depending on document readiness and underwriting timelines.

No. Our funding strategies are credit-based, meaning we don’t require collateral, tax returns, or traditional revenue verification.