- info@hawthornecorporatecredit.com

- 3435 Wilshire Blvd. 14th floor. Los Angeles, CA 90010

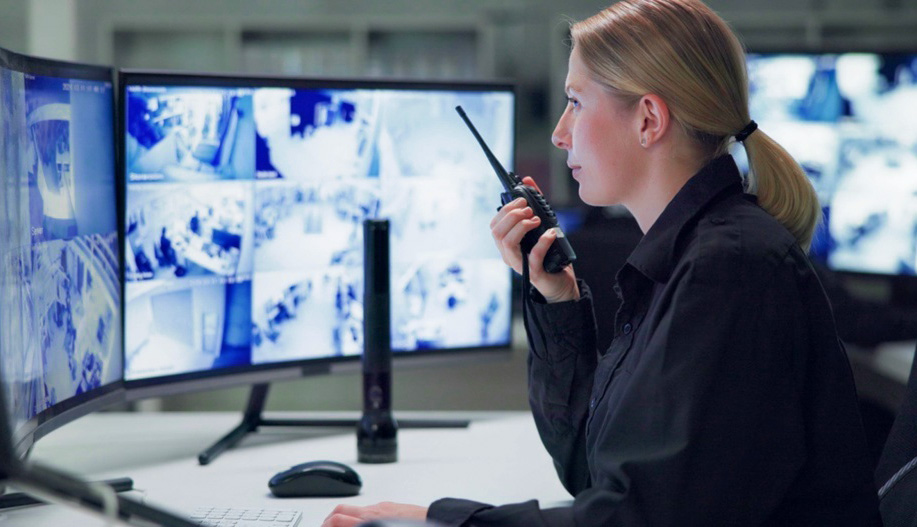

Ironclad Security Group LLC

NEVADA LIMITED LIABILITY COMPANY – SECURITY & SURVEILLANCE SERVICES

EST. 2019 | AGED / SEASONED NEVADA SECURITY-CLASS ENTITY: 5+ YEARS

Ironclad Security Group LLC is a clean, non-operational security and surveillance entity established in 2019 and structured to meet modern underwriting and compliance standards. This Nevada LLC maintains active Secretary of State standing, an established federal EIN, and a D&B-clear profile, positioning it as a strong candidate for credit-based funding and institutional review.

The entity is purpose-built to mirror the profile of a professional security services firm—an industry lenders associate with contract-based revenue, regulated operations, and repeat institutional clients. Included is a full documentation package: Articles of Organization, operating agreement, company resolutions, membership certificates, company minutes, and a complete corporate record kit, prepared for immediate transfer and funding preparation.

-

Credit Partner

CFO / Credit Partner Available

-

SIC Code

7381 – Detective, Guard & Armored Car Services

-

Estimated Cost

$68,500.00

-

Estimated Funding Capability

$410,000.00+

A Security-Class

Entity Positioned

for Institutional Trust

Although non-operational, Ironclad is designed to reflect the framework of a firm capable of servicing corporate, municipal, and national security contracts. This positioning allows a new owner to present as an established security provider rather than a newly formed business—an advantage when pursuing unsecured business credit or contract-aligned financing.

The entity’s structure emphasizes underwriting clarity: verified corporate age, compliant Nevada filings, complete governance documentation, EIN and D&B-clear status, and optional CFO/Credit Partner alignment to enhance financial presentation when needed. For entrepreneurs seeking leverage in a tightly regulated industry, this corporation offers a strategic starting point.

- Regulation-Oriented Corporate Profile. Security services are evaluated through a compliance-first lens—making clean filings and documentation critical for lender confidence.

- Complete Governance & Record Set. Articles, operating agreement, resolutions, minutes, membership certificates, and a full corporate record book assembled for review.

- Institutional Industry Classification. SIC 7381 aligns with contract-based security services often associated with government, infrastructure, and enterprise clients.

- Funding-Prepared Entity Design. Established EIN, D&B-clear profile, and structured to meet or exceed current underwriting standards for unsecured business credit.

A Strategic

Corporate Vehicle

for Capital Formation

Security and surveillance firms are often viewed as controlled-risk, contract-driven businesses, supporting stated-income lines of credit, business credit cards, and unsecured term loans. When paired with a qualified CFO/Credit Partner—if required—this entity can support layered funding strategies designed for acquisitions, operational launch, equipment deployment, or capital investment into parallel ventures.

For capital-focused buyers seeking a disciplined, lender-respected profile, Ironclad Security Group LLC offers a measured yet powerful platform for raising serious money.

Structured Access to Mid–Six-Figure Credit Facilities

Immediate Credibility in Banking & Contract Environments

-

Previous

Atlas Ledger & Tax Group, Inc.

-

Next

Blue Horizon Wellness Inc.